Let’s be real for a second. The word loan usually makes people tense up. Shoulders tighten, brain goes into “what’s the catch?” mode, and suddenly everyone becomes a financial detective. That’s exactly why Onnilaina caught my attention. The name feels… lighter. Almost friendly. And once I looked into it, I realized there’s a reason people keep searching for it.

So if you’re curious about Onnilaina, what it actually means, why it shows up in both fintech and lifestyle conversations, and whether it deserves your attention, you’re in the right place. Let’s talk about it like friends who enjoy understanding money without the headache.

What Onnilaina Actually Means (And Why the Name Matters)

Here’s a fun little detail most people miss. Onnilaina comes from Finnish roots, and the meaning isn’t boring at all.

-

“Onni” means luck or happiness

-

“Laina” means loan

Put them together and you get something close to “a lucky loan” or “a loan that supports happiness.” That’s clever branding if you ask me. Ever wondered why names matter so much in fintech? Because money already stresses people out, and a softer concept helps lower that mental barrier.

When I first read that, I thought, “Okay, that’s kind of refreshing.” Loans don’t usually try to sound human. Onnilaina does.

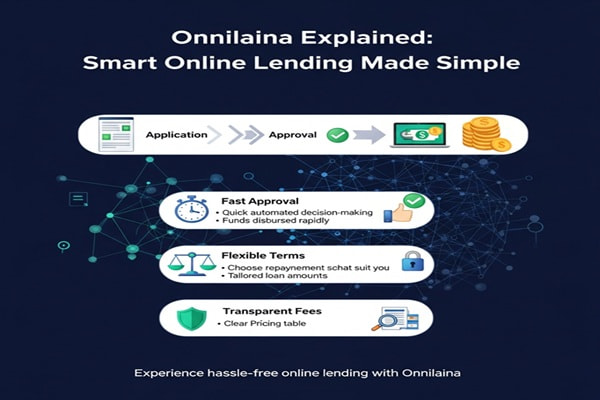

Onnilaina as a Modern Online Lending Concept

Now let’s talk about how people actually use the term today. Most references point to Onnilaina as a digital-first online lending concept, not just a poetic word.

Think fast applications, minimal paperwork, and decisions that don’t take forever. That’s the promise people associate with Onnilaina-style platforms.

Instead of traditional banking hoops, the idea focuses on:

-

Simple online forms

-

Quick eligibility checks

-

Clear terms

-

Flexible borrowing options

IMO, this reflects exactly where online lending is heading. People want speed and clarity, not a stack of confusing documents.

Why Online Lending Keeps Moving This Way

Let me ask you something when was the last time you enjoyed visiting a bank branch? Exactly.

Digital lending platforms gained popularity because they:

-

Respect your time

-

Reduce friction

-

Offer transparency upfront

Onnilaina fits neatly into that trend. It doesn’t reinvent money. It just removes the unnecessary pain around borrowing.

Key Features Commonly Associated With Onnilaina

Different sources describe slightly different implementations, but the core ideas stay consistent. Here’s what usually comes up when people talk about Onnilaina.

Fast and Fully Online Applications

Nobody wants to wait weeks for an answer. Onnilaina-style lending focuses on speed without chaos.

You typically see:

-

Online applications that take minutes

-

Quick verification processes

-

Faster approval timelines

I’ve tried slow loan processes before, and trust me, speed alone feels like a win.

User-Friendly Design

Another thing that stands out is accessibility. These platforms aim to work for regular people, not just finance pros.

That usually means:

-

Clean interfaces

-

Simple language

-

Clear next steps

Ever clicked “Apply Now” and immediately regretted it? Onnilaina’s concept tries to avoid that moment.

Transparent Terms (No Fine-Print Gymnastics)

This part matters more than people admit. Onnilaina-related platforms emphasize clarity.

You usually see:

-

Clearly stated interest rates

-

Defined repayment schedules

-

No mystery fees popping up later

Sarcasm alert: nobody enjoys discovering surprise charges like they’re Easter eggs.

Onnilaina vs Traditional Loans: A Fair Comparison

Let’s put this side by side, friend-to-friend.

Traditional Loans Often Feel Like:

-

Long paperwork

-

In-person visits

-

Slow approvals

-

Rigid terms

Onnilaina-Style Lending Feels More Like:

-

Digital-first convenience

-

Faster decisions

-

Flexible structures

-

Clear communication

I won’t say traditional banks don’t matter they do. But for short-term needs or quick access, Onnilaina’s approach feels more aligned with real life.

Is Onnilaina Only About Money? Surprisingly, No

Here’s where things get interesting. Some sources discuss Onnilaina beyond finance, almost as a concept tied to opportunity and support.

Because of its linguistic roots, people also use the term to represent:

-

Help at the right moment

-

Financial breathing room

-

Access without shame

That emotional layer makes it stand out. Money decisions carry weight, and language shapes how we experience them.

Who Typically Looks for Onnilaina?

Based on how the term gets used, Onnilaina attracts a specific kind of audience.

Common Use Cases Include:

-

Covering short-term expenses

-

Managing unexpected costs

-

Supporting personal projects

-

Bridging temporary financial gaps

Ever faced a moment where timing mattered more than amount? That’s exactly where this concept fits.

How Onnilaina Fits Into the Future of Smart Lending

Let’s zoom out for a second. Fintech keeps evolving, and Onnilaina represents a shift in mindset, not just technology.

The future of lending focuses on:

-

Personalization over rigidity

-

Speed without recklessness

-

Clarity instead of confusion

-

Human-centered design

FYI, platforms that ignore these trends tend to fade fast.

Risks and Realism: Keeping Expectations Grounded

Alright, time for honesty. Even the nicest-sounding loan still counts as a loan.

Onnilaina-style lending works best when users:

-

Borrow intentionally

-

Understand repayment terms

-

Avoid emotional decisions

-

Read everything carefully

Quick access doesn’t remove responsibility. It just removes unnecessary friction.

My Personal Take on the Onnilaina Concept

I like ideas that make finance feel less intimidating. Onnilaina does exactly that through language and design philosophy.

If I needed quick, clearly defined borrowing without bank bureaucracy, I’d prefer something aligned with this approach. I’d still read the terms carefully always but I appreciate platforms that treat users like adults instead of obstacles.

That balance matters.

How to Decide If Onnilaina-Style Lending Is Right for You

Ask yourself a few honest questions:

-

Do I need speed more than long-term structure?

-

Can I repay comfortably within the timeline?

-

Do I understand the costs clearly?

If the answers line up, this approach makes sense. If not, stepping back always beats rushing forward :/

Why the Term Onnilaina Keeps Gaining Attention

People don’t just search for Onnilaina because of loans. They search because it sounds different.

It combines:

-

Financial practicality

-

Emotional reassurance

-

Cultural meaning

That’s rare. Most financial terms feel cold. This one feels… human.

Also Read : Antarvacna: The Inner Voice You Didn’t Know You Needed

Common Misunderstandings About Onnilaina

Let’s clear a few things up.

-

Onnilaina isn’t a magic loan. You still repay it.

-

It isn’t a guarantee of approval. Eligibility still matters.

-

It isn’t risk-free. No loan ever is.

But it does represent a smarter, more respectful approach to borrowing.

Onnilaina and Responsible Borrowing Go Hand in Hand

The smartest users treat Onnilaina as a tool, not a solution to everything.

Responsible use looks like:

-

Borrowing for clear reasons

-

Planning repayment upfront

-

Avoiding repeat dependency

That’s how lending supports happiness instead of stress which, ironically, fits the name perfectly.

Final Thoughts on Onnilaina

So here’s the takeaway, friend. Onnilaina blends modern fintech convenience with a human-centered philosophy. It doesn’t try to scare you with complexity or overwhelm you with jargon. It aims to simplify borrowing while respecting your time and intelligence.

If you approach it thoughtfully, understand the terms, and borrow with intention, it can genuinely support financial flexibility. And honestly, anything that makes money feel a little less intimidating earns my respect.